BTC Price Prediction: 2025-2040 Outlook Amid Institutional Adoption and Market Volatility

#BTC

- Technical indicators show BTC testing crucial support levels with MACD signaling short-term bearish momentum

- Institutional adoption continues growing with public companies holding over 1 million BTC, providing structural support

- Macroeconomic factors and Federal Reserve policy decisions remain key near-term price drivers

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Support

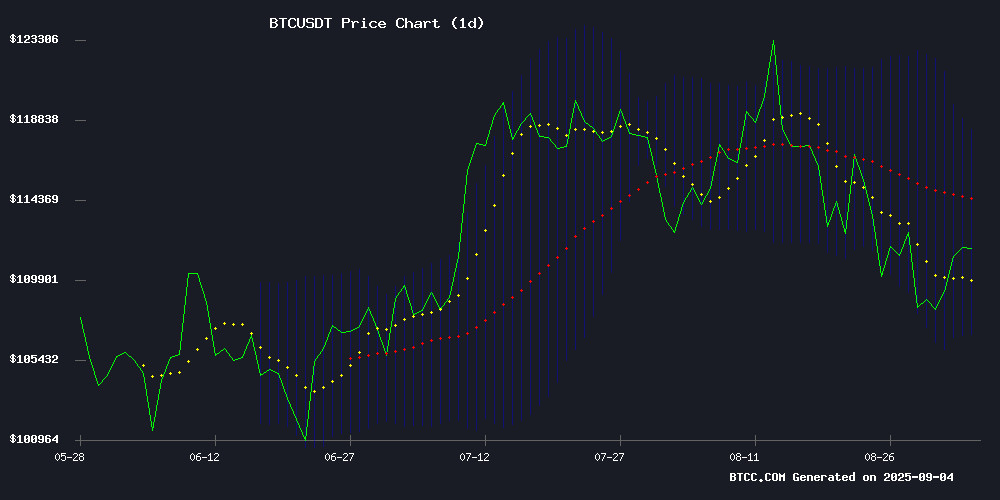

BTC is currently trading at $109,602.57, below its 20-day moving average of $112,472.72, indicating potential short-term weakness. The MACD reading of -110.20 suggests bearish momentum, though the price remains within the Bollinger Bands range of $106,607.07 to $118,338.37. According to BTCC financial analyst Michael, 'The current technical setup shows BTC testing crucial support levels. A break below $106,600 could signal further downside, while holding above this level may set the stage for a rebound toward the upper band.'

Market Sentiment: Institutional Developments Offset by Macro Concerns

Recent news highlights both supportive and cautionary factors for Bitcoin. Positive developments include American Bitcoin's 18% surge on Nasdaq debut with Trump family backing and public companies now holding over 1 million BTC. However, Australian SMSFs reducing crypto exposure despite Bitcoin's 60% surge and bearish Bitcoin options positioning ahead of expiry create headwinds. BTCC financial analyst Michael notes, 'Institutional adoption continues to provide structural support, but traders are cautiously awaiting U.S. labor data for Federal Reserve policy clues. The market is balancing strong fundamentals against near-term macroeconomic uncertainties.'

Factors Influencing BTC's Price

American Bitcoin (ABTC) Surges 18% on Nasdaq Debut Amid Trump Family Backing

American Bitcoin Corp (ABTC), a cryptocurrency mining and holding company co-founded by Eric Trump and endorsed by Donald Trump Jr., made a volatile Nasdaq debut. Shares opened at $8, peaked at $14 intraday, then settled 17% higher—a first-day performance that drew 29 million shares traded. The Trump-linked venture combines Hut 8 Mining's operational expertise with political star power, creating unusual market magnetism.

The company's hybrid model—blending direct Bitcoin mining with strategic BTC acquisitions—diverges from pure-play miners. Market enthusiasm reflects both speculative fervor and curiosity about politically connected crypto ventures. Yet the sharp post-rally pullback underscores the fragility of IPO momentum in digital asset equities.

Australian SMSFs Reduce Crypto Exposure Despite Bitcoin's 60% Surge

Self-Managed Super Funds in Australia bucked global crypto adoption trends, decreasing digital asset holdings by 4% to $1.97 billion even as Bitcoin rallied 60% year-over-year. The Australian Taxation Office's June 2025 report reveals this counterintuitive movement during a period of significant market growth.

Demographic data shows Australians aged 25-34 maintain the strongest crypto allocation, prompting exchanges like Coinstash to develop specialized SMSF products. This contrasts with accelerating institutional adoption in the US and UK, where retirement funds increasingly incorporate digital assets.

Market analysts question the ATO data's completeness, noting discrepancies between reported outflows and Bitcoin's price action. 'The figures might not capture the full picture,' suggests Simon Ho of Coinstash, highlighting potential reporting gaps in SMSF crypto allocations.

Will Institutional Buying Push BTC Price USD to New Highs?

Bitcoin's price trajectory remains a focal point as exchange outflows and institutional demand signal potential upward momentum. Recent data from CryptoQuant highlights significant BTC withdrawals from Kraken—nearly 65,000 BTC over two days—contrasting with typical market-top behavior where exchange inflows dominate. This suggests accumulation by large players rather than distribution by retail investors.

Historically, retail demand surges near bull market peaks, but current conditions indicate subdued participation. Institutional activity, however, continues to bolster confidence in Bitcoin's near-term prospects. Liquidation levels are tightening, positioning September as a critical month for BTC's next major move.

Bitcoin Treasury Companies Experience Heightened Volatility Compared to Bitcoin

Bitcoin's notorious price swings are wreaking havoc on publicly traded companies holding the cryptocurrency as treasury assets. Stocks of Bitcoin Treasury Companies (BTCTCs) have plummeted 50-80% during recent market downturns, far exceeding Bitcoin's own volatility. Metaplanet (MTPLF), a prominent example, endured twelve distinct bear markets within just eighteen months—some lasting up to four months.

While Bitcoin's price movements remain the dominant factor, corporate actions are amplifying the turbulence. Only 41.7% of Metaplanet's stock corrections aligned with Bitcoin's downturns, indicating significant internal drivers. Capital raises and fluctuating Bitcoin premiums create additional layers of volatility, making these stocks a high-stakes play on crypto adoption.

GameStop's Q2 Earnings Under Scrutiny Amid Bitcoin Concerns and Sales Decline

GameStop Corp. (GME) faces heightened scrutiny as it prepares to report second-quarter earnings on September 9. The meme stock has slumped 27% year-to-date, weighed down by weak retail sales, skepticism over its Bitcoin strategy, and uncertainty about its cash deployment. Wedbush analyst Alicia Reese maintains a bearish stance, projecting over 40% downside from current levels.

Wall Street anticipates earnings of $0.19 per share, a significant improvement from $0.01 in the year-ago quarter, with revenue expected to climb 13% to $900 million. The previous quarter delivered a profit surprise at $0.17 EPS against $0.04 estimates, but revenue contracted 17% annually—highlighting the company's operational challenges.

Goldman Sachs Predicts Bitcoin Could Reach $220K if Gold Hits $5,000

Goldman Sachs analysts suggest a potential seismic shift in asset valuations, projecting gold could surge to $5,000 per ounce amid eroding confidence in Federal Reserve policies. This scenario might catalyze a 250% Bitcoin price appreciation for every 15% gold rally.

The yellow metal has already outpaced crypto's flagship asset in 2025, boasting 37% year-to-date gains versus Bitcoin's 22%. Market observers note strengthening correlation dynamics between the assets during periods of macroeconomic instability, with both benefiting from inflation hedging demand.

Current gold futures set records at $3,630/oz as ETF holdings approach 3,000 tonnes. The bank's model implies Bitcoin could theoretically reach $220,000 should gold achieve its $5,000 target, though such projections remain contingent on sustained risk-off sentiment and monetary policy developments.

ZA Miner Democratizes Bitcoin Cloud Mining with $100 Bonus and $14K+ Passive Income Potential

Bitcoin mining, once the exclusive domain of tech-savvy investors with expensive hardware, is now accessible to all through platforms like ZA Miner. The UK-based company, established in 2020, offers cloud mining contracts that promise passive income up to $14,000—without the need for physical equipment or technical expertise.

New users receive a $100 welcome bonus to start mining immediately, eliminating financial barriers. ZA Miner's mobile app and user-friendly interface simplify the process, while its eco-friendly ASIC and GPU-powered infrastructure ensures compliance and security.

The platform's SAFE-certified operations and transparent model mark a shift toward inclusive crypto participation. Cloud mining is no longer a niche pursuit but a viable passive income stream for mainstream investors.

Public Companies Now Hold Over 1 Million Bitcoin, A Historic First

Publicly traded companies have collectively amassed more than 1 million Bitcoin for the first time, marking a watershed moment for institutional adoption of the cryptocurrency. Strategy, formerly MicroStrategy, leads the pack with nearly 629,000 BTC, while mining firms like Marathon Digital Holdings and Riot Platforms contribute significantly to the milestone.

This accumulation reflects deepening corporate confidence in Bitcoin as a strategic reserve asset. Billions of dollars funneled into BTC holdings underscore cryptocurrency's irreversible penetration into traditional finance.

Crypto Market Awaits Key U.S. Labor Data for Fed Rate Clues

The cryptocurrency market braces for volatility as two critical U.S. labor reports—ADP Nonfarm Employment Change and Initial Jobless Claims—take center stage today. These metrics could dictate the Federal Reserve's monetary policy trajectory, with ripple effects across risk assets including Bitcoin.

At 8:15 a.m. ET, the ADP report is expected to show just 73,000 new private-sector jobs in August, a significant cooling from July's 104,000. A soft reading may fuel expectations of imminent rate cuts, historically a tailwind for crypto valuations. Conversely, stronger-than-forecast data could pressure BTC's current trading range.

The 8:30 a.m. ET Jobless Claims release serves as a concurrent health check. Analysts anticipate 230,000 filings, marginally above last week's 229,000. Accelerating unemployment claims would reinforce labor market weakness—a scenario likely to amplify crypto's appeal as hedge assets.

MicroStrategy's Cycle Peak Aligns with IBIT Options Launch as Bitcoin Nears $100K

BlackRock's iShares Bitcoin Trust (IBIT) options saw explosive trading activity upon their November debut, with first-day volume exceeding $2 billion. This surge coincided with MicroStrategy (MSTR) reaching a cycle peak in its multiple to net asset value (mNAV) at 3.141, as bitcoin approached $100,000 and MSTR stock hit a record $540.

Since November's highs, MicroStrategy has declined 40%, with its mNAV compressing to 1.55. The company's bitcoin holdings have grown substantially to 331,200 BTC, representing a 305,000 BTC increase from earlier positions. MSTR continues to serve as a unique hybrid instrument, offering both leveraged bitcoin exposure and options trading capabilities - a distinction from IBIT's pure spot bitcoin access.

Despite IBIT's strong launch and steady growth, MicroStrategy has dramatically outperformed since spot bitcoin ETFs began trading in January 2024, boasting 515% gains versus IBIT's 128%. MSTR maintains leadership across key metrics including historical volume and volatility, even as bitcoin's implied volatility remains subdued below 40.

Bitcoin Options Show Bearish Bias Ahead of Friday's Expiry

September's crypto markets mirror August's lethargy—thin volumes, muted volatility, and a fixation on traditional finance cues. Gold briefly touched $3,560 before paring gains, while global bond yields stepped back from recent peaks.

Bitcoin perpetual funding rates cooled to ~6% after earlier double-digit spikes, as open interest dwindled to 720K BTC-denominated contracts. Public Bitcoin treasury firms saw shrinking multiples: MicroStrategy (mNAV 1.55), Metaplanet (1.71 after 7% drop), and KindlyMD (mNAV 2.5, down 75% from ATH).

All eyes now pivot to Friday's dual catalysts—$4.5B in Deribit crypto options expiry (including $3.28B BTC notional) and the U.S. jobs report. Bitcoin's max pain sits at $112K with a 1.38 put-call ratio, as put clustering at $105K-$110K strikes signals persistent downside hedging.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market developments, BTCC financial analyst Michael provides this outlook: 'While near-term volatility persists due to macroeconomic factors and options expiry pressure, Bitcoin's long-term trajectory remains bullish driven by institutional adoption, limited supply, and growing acceptance as a digital store of value.'

| Year | Price Prediction (USD) | Key Drivers |

|---|---|---|

| 2025 | $120,000 - $150,000 | ETF inflows, halving effects, institutional accumulation |

| 2030 | $250,000 - $400,000 | Mainstream adoption, regulatory clarity, scarcity premium |

| 2035 | $500,000 - $800,000 | Global reserve asset status, technological integration |

| 2040 | $1,000,000+ | Full digitization of value, network effects dominance |